GDX Fact Sheet: Navigating the Gold Mining ETF Landscape in 2025

Investing in the VanEck Vectors Gold Miners ETF (GDX) presents both opportunities and challenges. Understanding the GDX fact sheet is crucial for making informed investment decisions. This guide demystifies the key aspects of GDX, providing actionable intelligence for investors of all levels. The information presented here aims to empower investors, not overwhelm them with technical jargon. For further market analysis, check out this helpful resource.

Decoding the GDX Fact Sheet: Key Metrics and Insights

The GDX fact sheet offers a comprehensive overview of the ETF's performance, holdings, and associated risks. Don't be intimidated by the financial terminology; this guide will break down the essential elements. Analyzing the fact sheet is like studying a company's financial reports—understanding its strengths and vulnerabilities.

Key Performance Indicators (KPIs) to Analyze:

- Historical Performance: Examine the GDX's performance over the past year, five years, and longer periods. Past performance isn't indicative of future results, but it provides valuable context. Is there a consistent upward trend, or are there significant periods of volatility? A visual representation (chart) would be helpful here.

- Expense Ratio: This represents the annual cost of owning the ETF, expressed as a percentage of assets. Lower expense ratios translate to greater returns over time. Compare GDX's expense ratio to competing gold mining ETFs to assess its competitiveness.

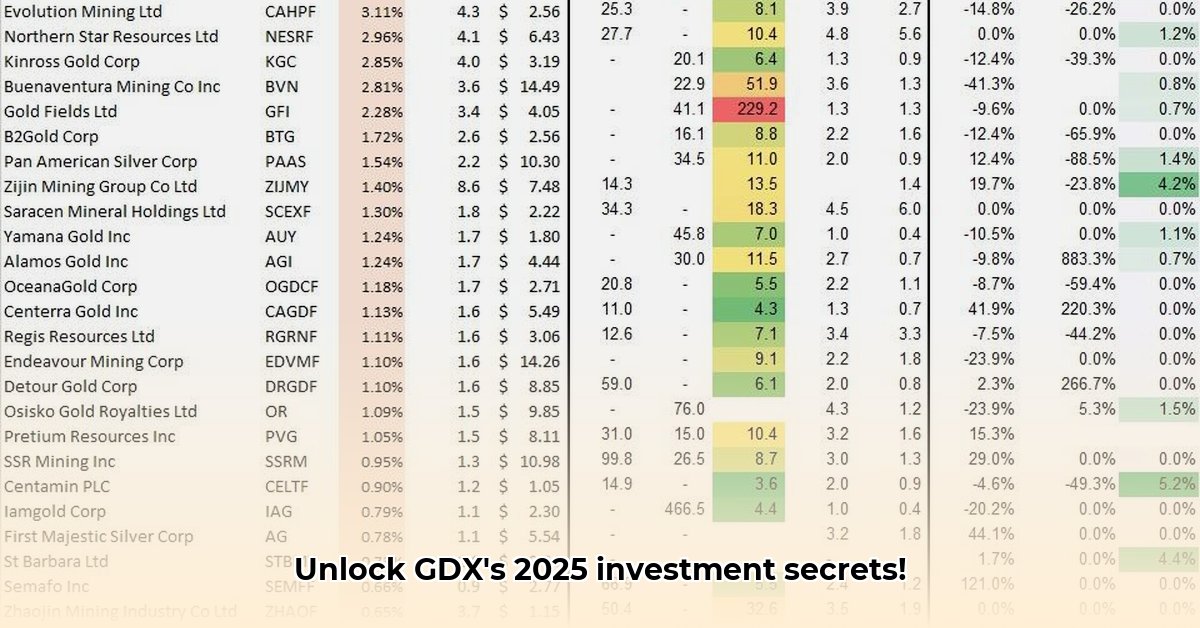

- Portfolio Holdings: The fact sheet details the specific gold mining companies within the GDX portfolio, along with their respective weightings. Understanding the concentration of holdings can reveal potential risks (high concentration in a single company) or diversification benefits (spread across many companies). Does the ETF's investment strategy align with your values, particularly in terms of ESG (environmental, social, and governance) factors?

Understanding the Risks and Rewards of Investing in GDX

Investing in GDX, like any investment in commodities, carries inherent risks. Gold prices are influenced by numerous factors: macroeconomic conditions, geopolitical events, investor sentiment, and speculation. These factors can lead to significant price volatility, directly impacting GDX's performance. The GDX fact sheet should clearly articulate these risks.

However, gold frequently serves as a safe-haven asset during periods of economic uncertainty. When equity markets decline, investors often flock to gold. Also, gold often acts as a hedge against inflation, helping to maintain purchasing power. This characteristic makes gold a valuable component of a diversified portfolio for many investors.

Your Actionable GDX Investment Strategy: A Step-by-Step Guide

Deep Dive into Historical Data: Conduct a thorough analysis of GDX's historical performance. Look for consistent trends and identify periods of volatility. Use reliable charting tools to visualize the data effectively.

Comparative Cost Analysis: Compare GDX's expense ratio with competitors. Even a seemingly small difference in the expense ratio can significantly affect long-term returns.

Scrutinize the Holdings: Carefully review the ETF's holdings. Identify any companies with high individual weightings and assess the associated risks. Research the ESG profiles of these companies if such factors are relevant to your investment philosophy.

Stay Informed on Market Conditions: Keep abreast of global economic developments and industry-specific news impacting gold prices. Reliable sources like the World Gold Council and reputable financial news outlets can help with this.

Strategic Portfolio Diversification: Remember that diversification is key to mitigating risk. Gold is a valuable asset class, but don't rely solely on GDX. Incorporate other asset classes into your portfolio, such as stocks, bonds, and real estate, considering your individual risk tolerance and long-term investment objectives.

Risk Mitigation Strategies: A Diversified Approach

Diversification is paramount when investing in GDX. This is not about eliminating risk entirely but managing it effectively. A diversified portfolio reduces dependence on any single investment's performance. A balanced portfolio should ideally include multiple asset classes that respond differently to market forces.

Is it wise to use GDX as the sole gold exposure in your portfolio? Likely not. It's important to consider alternative gold investments, including physical gold and other gold ETFs, to diversify further.

Here are additional risk mitigation strategies:

- Regular Portfolio Rebalancing: Periodically adjust your portfolio's asset allocation to maintain your target balance. This ensures your risk exposure remains aligned with your goals.

- Correlation Analysis: Assess the correlation between GDX and other assets in your portfolio. Aim for lower correlations to reduce overall portfolio volatility.

- Consult a Financial Advisor: A qualified financial advisor can provide personalized guidance based on your circumstances and risk tolerance.

Key Takeaways:

- GDX offers exposure to the gold mining sector but carries considerable risk due to gold price volatility and the performance of individual mining companies.

- Diversification across different asset classes is crucial for mitigating risk.

- Understanding the ETF's holdings and expense ratio is vital for informed decision-making.

- Regular monitoring and rebalancing are essential for maintaining a well-structured investment strategy.

This guide provides a framework for understanding GDX. Conduct thorough research, and consult with a financial professional before making any investment decisions. Remember that past performance is not a guarantee of future results.